Already everyone's bank. Now, KakaoBank.

A bank that started for each customer has become a bank for everyone that more and more people are looking for.

Easier account creation and easier transfers on mobile.

Open accounts without certificates or OTP.

Multiple transfers are only a few taps away.

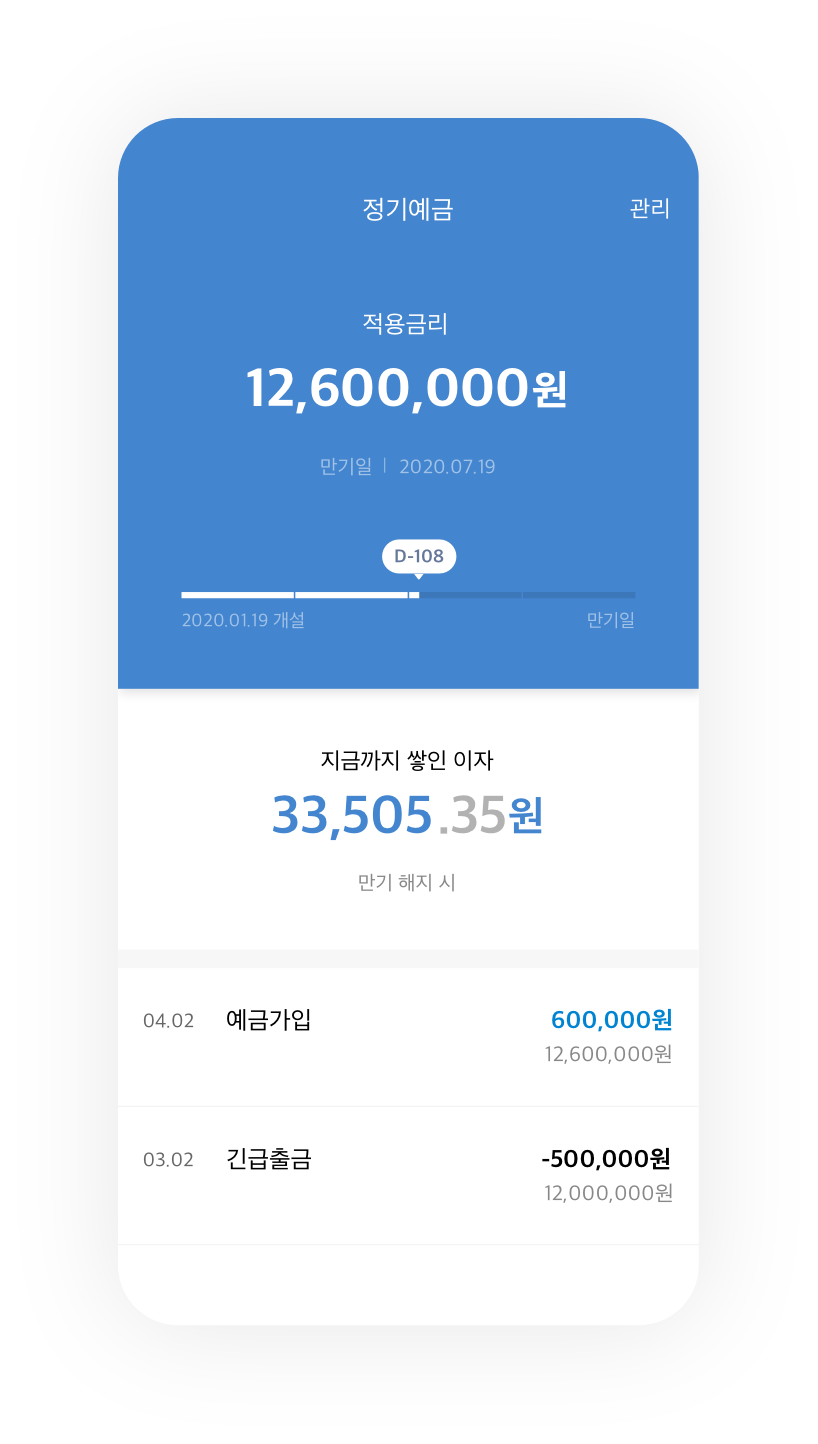

Competitive deposit and savings accounts without preferential terms.

Ever been disappointed by complicated terms that turned out different from the advertised rate? KakaoBank deposit and savings accounts are reasonable and easy for anyone, without any hidden terms

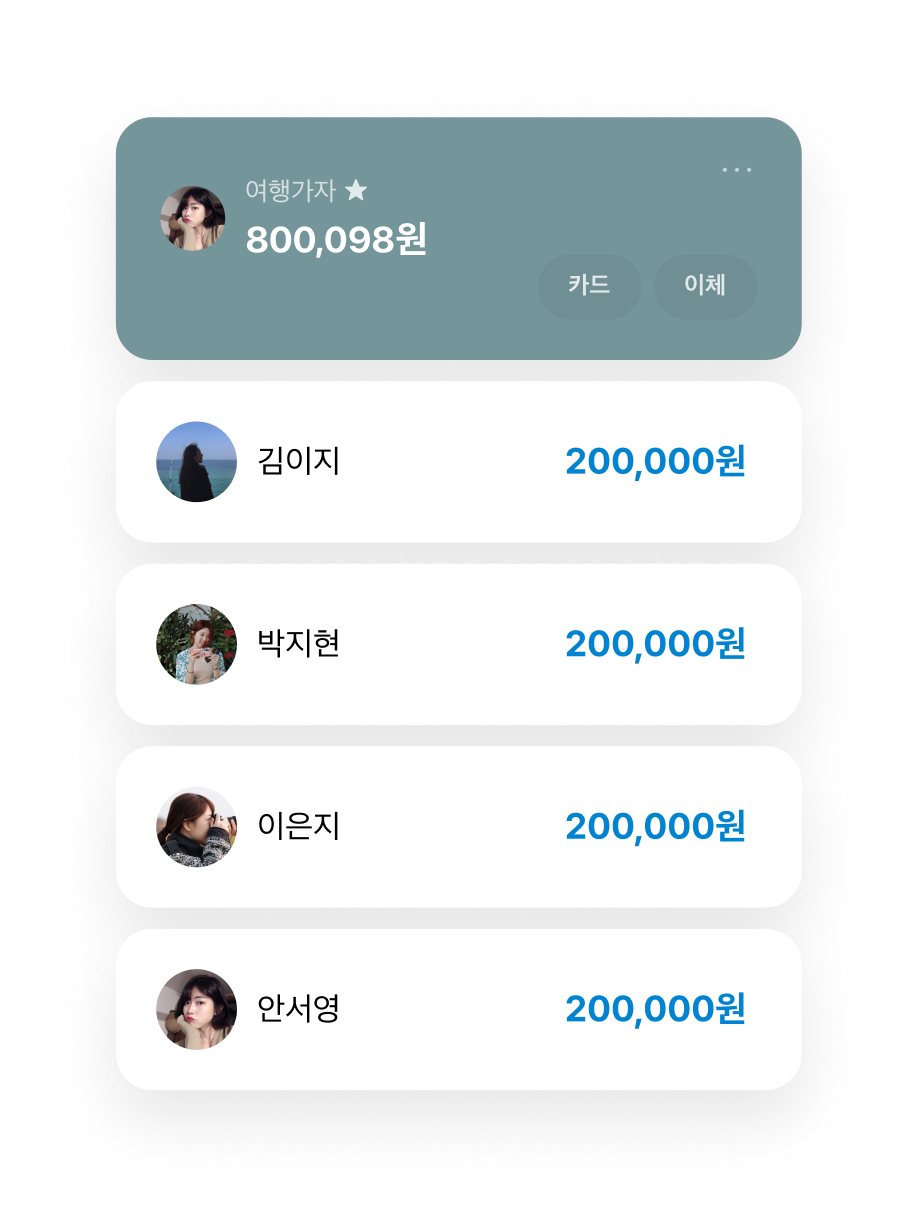

Group Account to share and view together

Invite your KakaoTalk friends to your Group Account now to share its balance and deposit & withdrawal histories. Request a membership deposit with fun message cards.

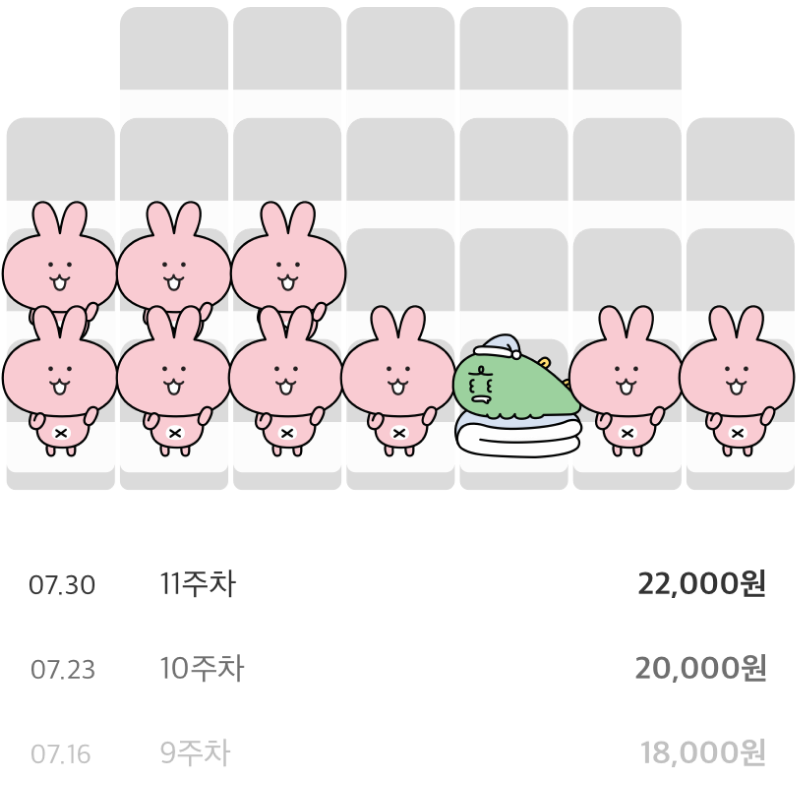

Fun 26-week deposit challenges.

Immerse yourself in 26 weeks of dynamic fun and you'll reach your goal in no time.

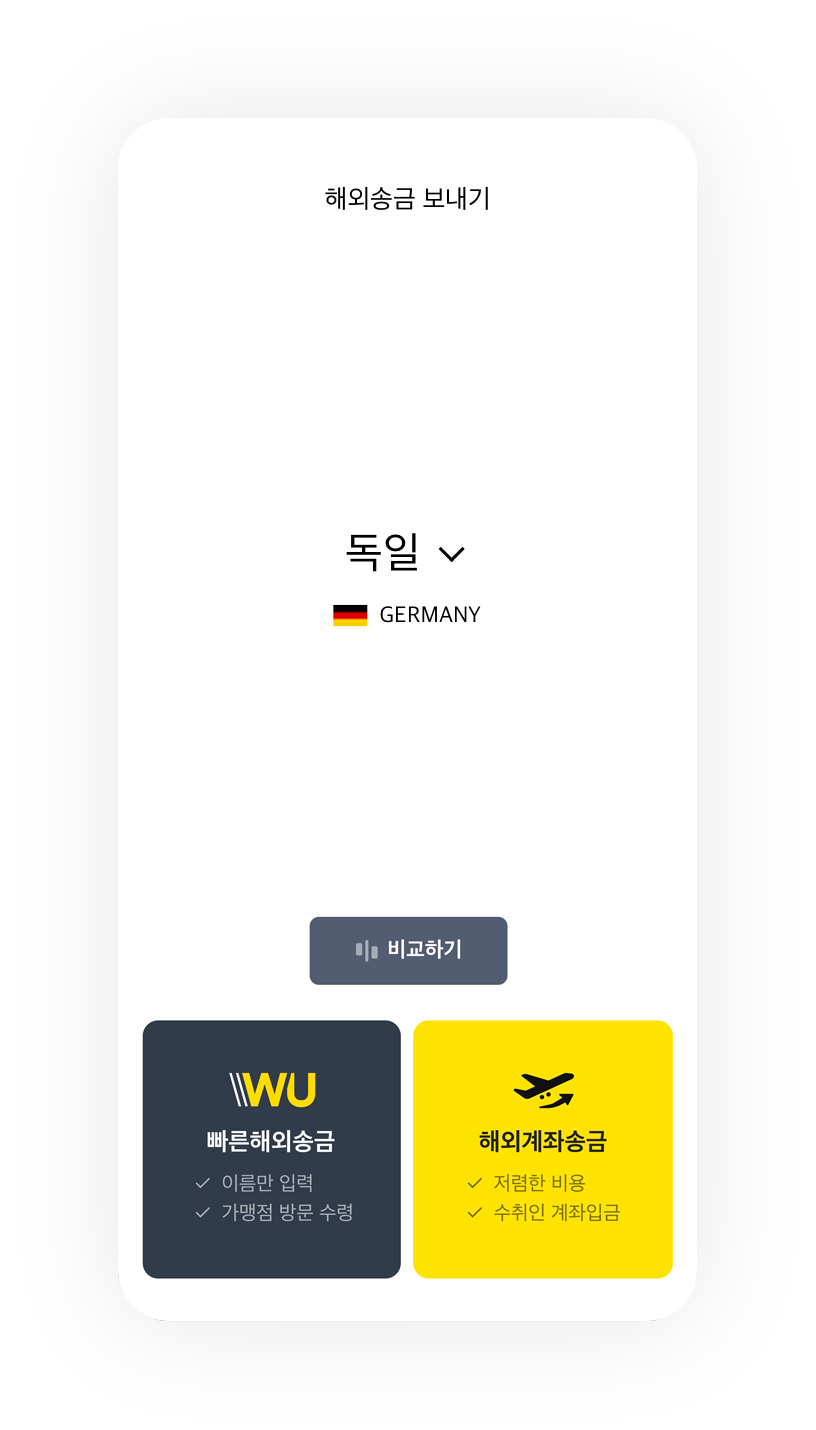

Overseas account remittance and WU fast international remittance made easier and cheaper.

Western Union fast international transfers are available across the globe in more than 200 countries, including 22 countries where overseas account transfers are possible.

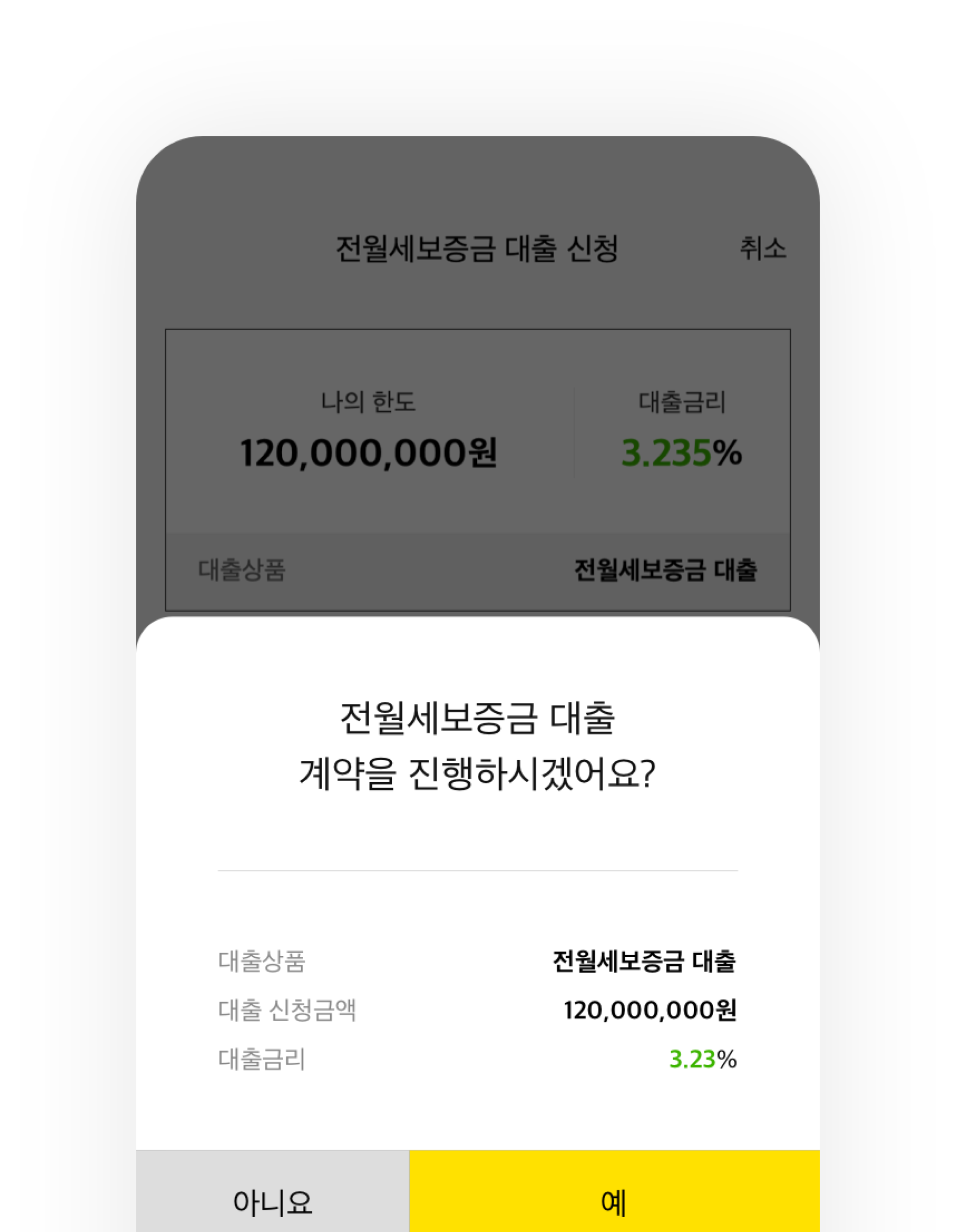

Simplified paperwork and accessible hours,

suited to your needs.

Housing deposit loans are available even when your moving date is on a weekend or public holiday.

Friends Debit Card The choice is all yours.

From Friends designs to a stylish black color, choose the design and features you like!

Making KakaoBank with technology

Concise and Elegant

Suitable for small smartphone screens. A charming and user-friendly UX without the complexity.

Easy Certification, Airtight Security

Certification made easy with fingerprints and passwords. Powerful security verification and data encryption technology.

Mobile First, One App

Banking made easier and more convenient in a single mobile app without the need to install multiple apps.